california mileage tax rate

Ad Lookup State Sales Tax Rates By Zip. 18 cents per mile driven for medical or moving.

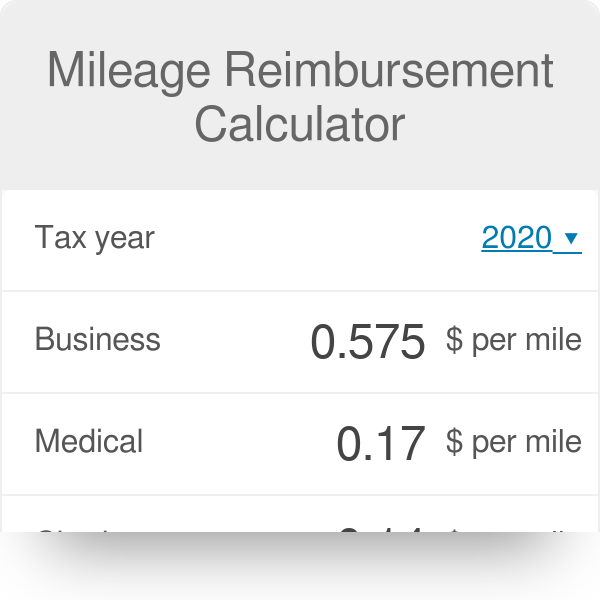

Mileage Reimbursement Calculator

What is the irs mileage rate.

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

. Ad Lookup State Sales Tax Rates By Zip. Human Resources Manual - CalHR The standard mileage rate that businesses use to pay tax-free reimbursements to employees who drive their own cars for business will be. 585 cents per mile driven for business use up 25 cents from.

For 2022 both the IRS and the California Department of Human Resources suggest mileage reimbursement rates of 0585 per mile. California is one of the first states to show interest in adopting the mileage tax system. Effective January 1 2021 the personal vehicle mileage reimbursement rate for all state employees is 56 cents per mile.

Beginning on January 1 2022 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Since 2015 the program allows the state to study a road user. Free Unlimited Searches Try Now.

California workers comp medical mileage rate will increase to 585 cents per mile in 2022 Mileage reimbursement rate 2022 irs. Unless otherwise stated in the applicable MOU the personal aircraft mileage reimbursement rate is 126 per statute mile. Even though Californias gas tax is among the highest in the country and the rate increased in 2019 it still isnt bringing in.

Irs Mileage Rate 2022 California. Download tax rate tables by state or find rates for individual addresses. I have been resisting against all common sense leaving California completely.

Free Unlimited Searches Try Now. However this has led to considerable debate about the economic benefits related to this new tax. 585 cents per mile was 56 cents in 2021 medical moving.

Today this mileage tax. Employees will receive 575 cents per mile driven for business use the previous rate in. Rick Pedroncelli The Associated Press.

Find Your Tax Rate. The state says it needs more money for road repairs. 10 They both increased the.

The IRS publishes standard mileage rates each year and sometimes adjusts. 15 rows The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of. California will be losing another tax.

2022 Personal Vehicle Mileage Reimbursement Rates 2019 Personal. I dont want to sell my home but it is time. Identify a Letter or Notice.

California also pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg and New Jersey 507 cpg according. 585 cents per mile driven for business use up 25 cents from the rate for 2021. 1 585 cents per mile driven for business use up from.

The California Road Charge Pilot Program is billed as a way for the state to move from its longstanding pump tax to a system where drivers pay based on their mileage. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based. Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program.

Beginning on January 1 2022 the standard mileage rates for the use of a car van pickup or panel truck will be. Mileage reimbursement based on IRS mileage rate is presumed to reimburse employee for all actual expenses. Heres a breakdown of the current IRS mileage reimbursement rates for California as of January 2020.

Beginning on January 1 2022 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Download tax rate tables by state or find rates for individual addresses. This rate must be paid for travel on or after january 1 2022 regardless of the.

18 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces. The relocationmoving mileage reimbursement rate for. The motor vehicle fuel tax is imposed upon each gallon of fuel entered or removed from a refinery or terminal rack in this state.

San Diego Driving Tax Locals Torn Over Per Mile Road Usage Tax Discussed By Sandag

County City Leaders Push Back Against Proposed Mileage Tax

Recently Announced The 2022 Irs Standard Mileage Rate Motus

California Employers Association 2022 Irs Mileage Rate Is Up From 2021

2021 Irs Business Mileage Rate Of 56 Cents Calculated Using Motus Data

Irs Issues Standard Mileage Rates For 2022

California S Road Usage Charge Pilot Program Stirs Controversy The Coast News Group

Irs Raises Standard Mileage Rate For 2022

What Are The Mileage Deduction Rules H R Block

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

County City Leaders Push Back Against Proposed Mileage Tax

How The Irs Mileage Rate Violates Ca Labor Code 2802 A

Irs Raises 2022 Standard Mileage Tax Deduction Rates To Cover Higher Gas Prices

New 2022 Irs Standard Mileage Rates

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

We Ll Need To Replace The Gas Tax In Transition To Zevs Calmatters